fremont ca sales tax calculator

The sales tax rate does not vary based on zip. The Fremont sales tax rate is.

Why Are Property Taxes Higher As A Percentage In Austin Than They Are Even In Seattle Quora

Skip to main content.

. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Within Fremont there are around 5 zip codes with the most populous zip code being 94536. Sales Tax State Local Sales Tax on Food.

French Gulch CA Sales Tax Rate. The average sales tax rate in Colorado is 6078. Warm Springs Fremont 10250.

Good location in Fremont with security building. The December 2020 total local sales tax rate was 9250. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

John is wonderful at what he does. I dont know where my. Real property tax on median home.

Just enter the five-digit zip code of the location. Tax Return Preparation Financial Services 3 Website 510 494-2070. 2 beds 2 baths 1146 sq.

Integrate Vertex seamlessly to the systems you already use. If youre an online business you can connect TaxJar directly to your shopping cart and instantly calculate sales taxes in every state. The Fremont California sales tax rate of 1025 applies to the following five zip codes.

Real property tax on median home. Rates include state county and city taxes. The County sales tax rate is.

Wayfair Inc affect California. Then use this number in the multiplication process. Method to calculate Fremont County sales tax in 2021.

Average Local State Sales Tax. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. The current total local sales tax rate in Fremont CA is 10250.

Sales tax in Fremont Nebraska is currently 7. French Camp CA Sales Tax Rate. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

Fremont CA Sales Tax Rate. Find list price and tax percentage. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

SalesTaxHandbook visitors qualify for a free month by signing up via our partner program here. The sales tax rate for Fremont was updated for the 2020 tax year this is the current sales tax rate we are using in the Fremont Nebraska Sales Tax Comparison Calculator for 202122. The California sales tax rate is currently.

You can find more tax rates and allowances for Fremont and Nebraska in the 2022 Nebraska Tax Tables. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. 2022 Cost of Living Calculator for Taxes.

Moore Burkhardt Wealth Management. Look up 2022 sales tax rates for Fremont Minnesota and surrounding areas. Local tax rates in California range from 015 to 3 making the sales tax range in California 725 to 1025.

Name A - Z Sponsored Links. The minimum combined 2021 sales tax rate for fremont california is 1025. Search When autocomplete results are available use up and down arrows to review and enter to select.

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Income Tax Calculator in Fremont CA. Ad Manage sales tax calculations and exemption compliance without leaving your ERP.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. Multiply the price of your item or service by the tax rate. 42656 Fern Cir Fremont CA 94538 1649999 MLS 40987396 Corner Unit house 1633 sq ft with a big lot 5400 sq ft per county Vault Ceiling in.

The base state sales tax rate in California is 6. California has a 6 statewide sales tax rate but also has 474 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2617 on top. US Sales Tax Rates CA Rates Sales Tax Calculator Sales Tax Table.

Sales Tax Calculator Sales. Did South Dakota v. Fremont Sales Tax Rates for 2022.

Divide tax percentage by 100 to get tax rate as a decimal. If you have tax rate as a percentage divide that number by 100 to get tax rate as a decimal. Maximum Local Sales Tax.

Fremont in Nebraska has a tax rate of 7 for 2022 this includes the Nebraska Sales Tax Rate of 55 and Local Sales Tax Rates in Fremont totaling 15. Sales Tax Calculator in Fremont CA. The mandatory local rate is 125 which makes the total minimum combined sales tax rate 725.

Fremont California and San Jose California. The average cumulative sales tax rate in Fremont California is 1025. 2020 rates included for use while preparing your income tax deduction.

This includes the sales tax rates on the state county city and special levels. California State Sales Tax. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

If this rate has been updated locally please contact us and we will update the sales tax rate for Fremont Nebraska. Sales Tax State Local Sales Tax on Food. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property.

The Colorado sales tax rate is 29 the sales tax rates in cities may differ from 325 to 104. This is the total of state county and city sales tax rates. The latest sales tax rates for cities starting with F in California CA state.

California Department of Tax and Fee Administration Cities Counties and Tax Rates. 39993 Fremont Blvd Fremont CA 94536 649000 MLS 41001849 First floor unit remdeled. Calculate rates Calculate rates Menu.

Calculators Adding Machines Supplies Office Equipment Supplies Office Furniture Equipment 2 415 503-0302. Maximum Possible Sales Tax. Tax rates are provided by Avalara and updated monthly.

How to Calculate Sales Tax. San Francisco CA 94103. The minimum combined 2022 sales tax rate for Fremont California is.

Name A - Z Sponsored Links. Avalara provides supported pre-built integration. 2022 Cost of Living Calculator for Taxes.

Fremont is located within Alameda County California.

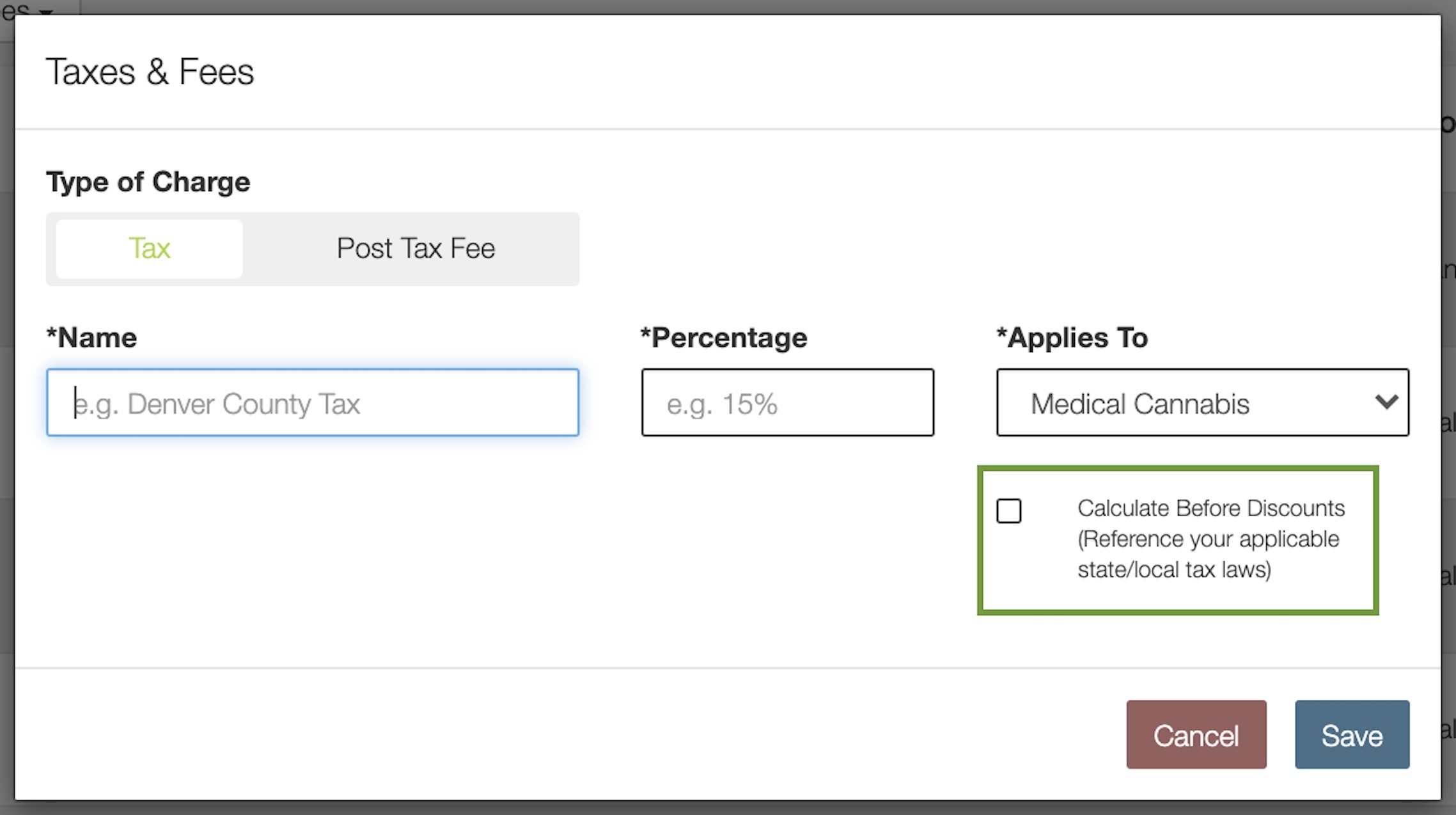

How To Calculate Cannabis Taxes At Your Dispensary

California Vehicle Sales Tax Fees Calculator

California Sales Tax Guide For Businesses

Tips For Living In Fremont Ca Is Moving To Fremont A Good Idea

Palo Alto California Sales Tax Calculator 2022 Investomatica

Palo Alto California Sales Tax Calculator 2022 Investomatica

California Sales Tax Rates By City County 2022

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

California Used Car Sales Tax Fees 2020 Everquote

California Vehicle Sales Tax Fees Calculator

California City County Sales Use Tax Rates

How To Calculate Cannabis Taxes At Your Dispensary

Ca Owner Sales Tax Registration License Fees Tesla Motors Club

Ca Owner Sales Tax Registration License Fees Tesla Motors Club

California Vehicle Sales Tax Fees Calculator

California Vehicle Sales Tax Fees Calculator

California Paycheck Calculator Smartasset

Why Are Property Taxes Higher As A Percentage In Austin Than They Are Even In Seattle Quora