nevada estate and inheritance tax

Nevada also does not have a local estate tax. 5740 million North Carolina.

Taxation In The United States Wikiwand

No estate tax or inheritance tax.

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

. The services provides thousands of web templates like the Nevada Estate and Inheritance Tax Return Engagement Letter - 706 which can be used for organization and private requires. Estate taxes are levied on the total value of a decedents property and must be paid out before distributions are made to the decedents beneficiaries. With a probate advance otherwise referred to as an inheritance cash advance you can receive funds immediately you can call us and we can have your cash to you within 24-72 hours with a stress free and considerate process.

If there is a tax the portion of tax that results from the property you inherit will usually be payable from your share. Inheritance and Estate Tax Rate Range. Zero No Nevada State Income Tax.

It is one of the 38 states that does not apply an estate tax. Otherwise no tax will be due. NV does not have state inheritance tax.

The highest sales tax In Las Vegas is 875. Nevada gift tax and inheritance tax planning. Nevada State Personal Income Tax.

Compare the best Estate Tax lawyers near Summerlin NV today. Use our free directory to instantly connect with verified Estate Tax attorneys. Nevada is one of the seven states with no income tax so the income tax rates regardless of how much you make are 0 percent.

Theres No Franchise Tax. But the state makes up for this with a higher-than-average sales tax. This is a tax that is assessed when beneficiaries receive money from an estate.

There are no estate or inheritance taxes in the state either. Nevada filing is required in accordance with Nevada law NRS 375A for any decedent who has property located in Nevada at the time of death December 31 2004 or prior and whose estate value meets or exceeds the level requiring a Federal Estate Tax return. If the time of death is on or after January 1 2005 Nevada does not require filing of Estate Tax and will not require filing.

No Estate Tax Laws in Nevada To beneficiaries of an estate learning that inherited property is located in Nevada can feel like watching all three wheels of a slot machine land on the number 7. Nevada does not have an inheritance tax. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax.

An estate that exceeds the Federal Estate Tax Exemption of 1206 million becomes subject to taxation. Property Tax In Southern Nevada is about 1 or less of the propertys value. However an estate in Nevada is still subject to federal inheritance tax.

Thats why Nevada is such a tax friendly state. Under Nevada law there are no inheritance or estate taxes. Sales tax is one area where Nevada could do better.

Whereas the inheritance tax is calculated separately for each individual beneficiary and the beneficiary is. Find an Attorney. In 2021 the first 117mil per individual is exempt at the federal level and therefore your estate will only pay tax if it is more than 117mil.

No estate tax or inheritance tax. Inheritance tax is different from estate taxes which is also different from although related to the gift tax. As mentioned previously the probate process in Nevada typically takes anywhere from eight months to three years to finalize.

No estate tax or inheritance tax. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year. But your inheritance can still become subject to federal estate taxation.

The federal government IRS may impose an inheritance tax is the value of the deceased persons entire estate is over 55 million as of 2018. Does Nevada Have an Inheritance Tax or Estate Tax. It is one of the 38 states that does not apply an estate tax.

The top estate tax rate is 16 percent exemption threshold. Search for legal issues. The federal estate tax exemption is 1118 million for 2018.

Search legal topics on LawInfo. Nevadas average Property Tax is 77 National average is 119. The state imposes a 685 tax and counties may tack on.

Property Tax Rate Range. Does Nevada Have an Inheritance Tax or Estate Tax. Since Nevada collects so much in gaming taxes they do not impose an inheritance tax or a gift tax.

The difference between inheritance and estate tax is a matter of who is responsible for paying the tax. No Nevada Inheritance Tax after 3 years of residency. Nevada does not have an estate tax but the federal government has an estate tax that may apply if your estate has sufficient value.

Search legal topics on LawInfo. Search Legal Resources. Compare the best Estate Tax lawyers near Pahrump NV today.

Use our free directory to instantly connect with verified Estate Tax attorneys. Find an Attorney. Search Legal Resources.

The top inheritance tax rate is 16 percent no exemption threshold New Mexico. Nevada Inheritance Tax and. No estate tax or inheritance tax.

Here are the answers to five common inheritance tax questions as it applies to beneficiaries that are residents of Nevada. The good news also is that the IRS does not impose an inheritance tax. Whether or not you will be required to pay an inheritance tax depends on which state you the beneficiary live in.

Anything more than 117mil can be taxed up to 40. Since the state does not impose an estate or inheritance tax upon death less money is deducted during probate than if the property was located in any other state in America. Search for legal issues.

Under Nevada law there are no inheritance or estate taxes. Theres No Corporate Income Tax. All of the kinds are checked by experts and fulfill state and federal requirements.

Taxation In The United States Wikiwand

Why You Need A Prenuptial Agreement Prenuptial Agreement Divorce Lawyers Prenuptial

What A Beneficiary Controlled Trust Can Do To Protect Your Legacy After You Are Gone Kiplinger Estate Planning Financial Asset Legacy

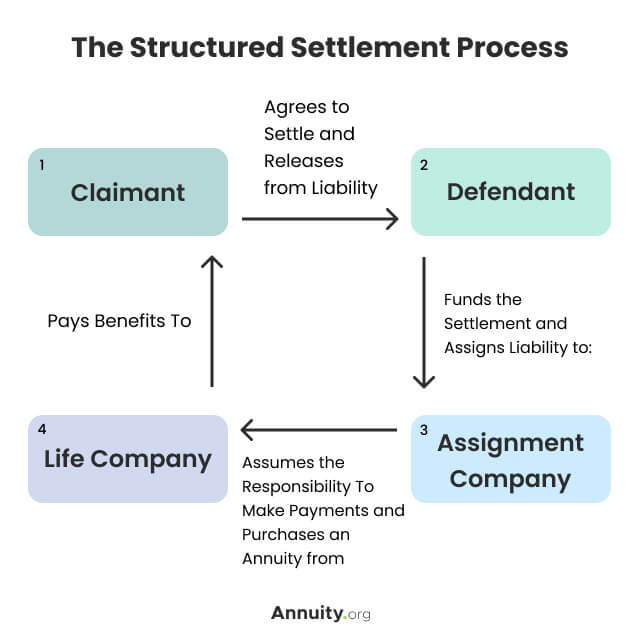

What Is A Structured Settlement And How Do They Work

The Most Tax Friendly U S State For Retirees Isn T What You D Guess And Neither Is The Least Tax Friendly Market Inheritance Tax Retirement Strategies Tax

Annuity Taxation How Various Annuities Are Taxed

Taxation In The United States Wikiwand

Highway And Road Expenditures Urban Institute

Annuity Taxation How Various Annuities Are Taxed

What Is The Risk Period For A Donation Of Movable Assets Three Years Five Years Or Seven Years Villas Decoration

Strategies To Preserve Step Up In Cost Basis Under New Tax Landscape Putnam Investments

Short Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

The Nine States With No Income Tax Is Yours On The List

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

2022 Federal State Estate And Gift Tax Cheat Sheet

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance